All Categories

Featured

Table of Contents

Different policies have different maximum degrees for the quantity you can spend, up to 100%., is added to the cash money value of the plan if the indexed account reveals gains (usually determined over a month).

This indicates $200 is added to the cash worth (4% 50% $10,000 = $200). If the index drops in worth or remains stable, the account webs little or nothing.

Having this suggests the existing cash value is shielded from losses in an inadequately doing market., the client does not take part in a negative attributing price," Niefeld claimed. In various other words, the account will certainly not shed its original cash money value.

No Lapse Universal Life

For example, a person who establishes the plan over a time when the marketplace is choking up can wind up with high costs payments that do not contribute in all to the cash value. The plan can after that possibly gap if the premium repayments aren't made in a timely manner later on in life, which can negate the point of life insurance coverage entirely.

Insurance coverage business commonly set maximum participation prices of less than 100%. These restrictions can limit the actual price of return that's credited toward your account each year, no matter of exactly how well the policy's hidden index does.

The insurance firm makes money by maintaining a part of the gains, including anything over the cap.

The possibility for a greater rate of return is one benefit to IUL insurance coverage plans compared to other life insurance coverage plans. Returns can in truth be lower than returns on other products, depending on exactly how the market carries out.

In the occasion of policy termination, gains become taxable as income. Costs are usually front-loaded and built into complex crediting price calculations, which might perplex some financiers.

Sometimes, taking a partial withdrawal will certainly likewise permanently reduce the death advantage. Terminating or giving up a plan can cause even more costs. Because case, the money surrender worth might be much less than the advancing costs paid. Pros Supply higher returns than various other life insurance policy policies Allows tax-free capital gains IUL does not decrease Social Safety and security benefits Policies can be developed around your risk appetite Disadvantages Returns capped at a particular level No assured returns IUL might have greater charges than other plans Unlike various other kinds of life insurance coverage, the worth of an IUL insurance plan is linked to an index connected to the securities market.

Flexible Premium Indexed Adjustable Life Insurance

There are lots of various other kinds of life insurance policies, clarified below. Term life insurance policy provides a fixed advantage if the insurance policy holder dies within a collection amount of time, usually 10 to 30 years. This is just one of one of the most cost effective kinds of life insurance policy, in addition to the most basic, though there's no cash worth buildup.

The policy obtains value according to a taken care of timetable, and there are fewer costs than an IUL insurance coverage policy. Variable life insurance comes with even more flexibility than IUL insurance coverage, meaning that it is also much more challenging.

An IUL plan can give you with the very same sort of coverage security that a irreversible life insurance policy plan does. Remember, this type of insurance policy stays intact throughout your entire life similar to other irreversible life insurance plans. It also permits you to develop money value as you obtain older through a stock exchange index account.

Variable Universal Life Insurance Calculator

Maintain in mind, though, that if there's anything you're uncertain of or you're on the fencing concerning obtaining any kind of sort of insurance, make certain to get in touch with a professional. In this manner you'll recognize if it's cost effective and whether it suits your financial plan. The price of an indexed global life plan depends upon numerous variables.

You will shed the fatality benefit called in the plan. Indexed universal life insurance policy and 401(k) prepares all have their own benefits. A 401(k) has even more financial investment choices to pick from and might include an employer match. On the other hand, an IUL includes a survivor benefit and an extra cash worth that the insurance holder can borrow versus.

Indexed universal life insurance policy can aid you meet your family's requirements for financial security while also developing money worth. These policies can be more complex contrasted to other types of life insurance policy, and they aren't necessarily right for every capitalist. Speaking with an experienced life insurance coverage representative or broker can help you determine if indexed universal life insurance policy is a good suitable for you.

Despite just how well you intend for the future, there are occasions in life, both anticipated and unanticipated, that can affect the monetary well-being of you and your enjoyed ones. That's a reason for life insurance. Survivor benefit is normally income-tax-free to beneficiaries. The fatality benefit that's typically income-tax-free to your recipients can aid guarantee your family members will be able to keep their standard of living, assist them keep their home, or supplement shed earnings.

Points like prospective tax obligation rises, rising cost of living, financial emergency situations, and preparing for occasions like college, retirement, and even wedding celebrations. Some kinds of life insurance policy can assist with these and other issues too, such as indexed global life insurance policy, or just IUL. With IUL, your policy can be a funds, due to the fact that it has the prospective to develop value gradually.

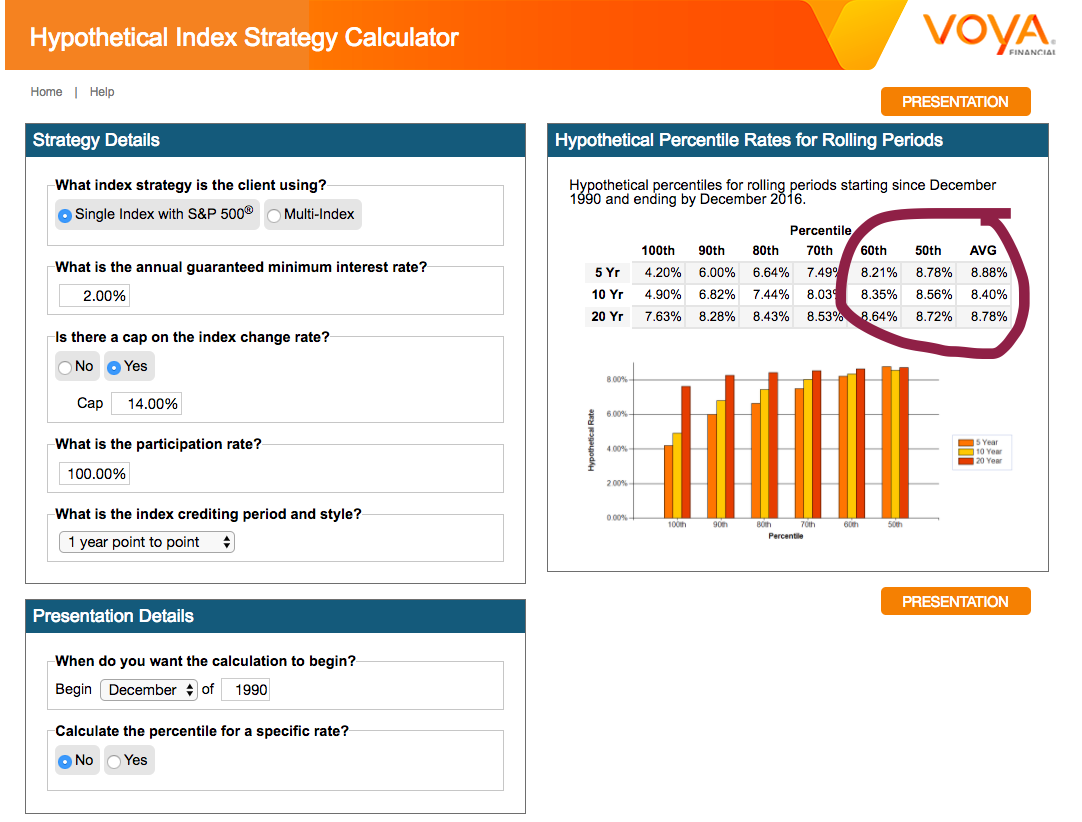

You can pick to receive indexed interest. Although an index may impact your interest attributed, you can not invest or directly join an index. Below, your policy tracks, however is not in fact bought, an exterior market index like the S&P 500 Index. This hypothetical example is offered illustratory functions only.

Iul Unleashed

Fees and expenditures might decrease policy worths. This rate of interest is secured in. So if the marketplace decreases, you will not shed any kind of interest because of the decline. You can additionally choose to receive set rate of interest, one set foreseeable rate of interest month after month, despite the marketplace. Because no single allotment will certainly be most effective in all market atmospheres, your monetary expert can assist you establish which mix might fit your monetary objectives.

That leaves much more in your policy to possibly maintain expanding over time. Down the road, you can access any readily available cash money value through plan car loans or withdrawals.

Talk with your financial specialist about how an indexed global life insurance coverage policy might be part of your total monetary method. This web content is for general academic functions only. It is not meant to offer fiduciary, tax obligation, or lawful guidance and can not be made use of to prevent tax fines; nor is it meant to market, promote, or suggest any tax plan or setup.

Best Iul Companies

In the event of a gap, outstanding plan car loans over of unrecovered expense basis will go through common earnings tax obligation. If a policy is a changed endowment contract (MEC), policy lendings and withdrawals will be taxable as common revenue to the level there are revenues in the policy.

These indexes are criteria just. Indexes can have various constituents and weighting methods. Some indexes have several versions that can weight elements or may track the influence of dividends differently. An index may affect your passion attributed, you can not purchase, straight get involved in or receive dividend settlements from any of them via the plan Although an outside market index may impact your rate of interest credited, your plan does not directly take part in any supply or equity or bond investments.

This content does not apply in the state of New York. Warranties are backed by the financial stamina and claims-paying capability of Allianz Life Insurance Policy Firm of North America. Products are issued by Allianz Life Insurance Policy Firm of The United States And Canada, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. .

Iul Illustration Example

The info and descriptions included below are not meant to be total summaries of all terms, problems and exclusions suitable to the services and products. The exact insurance protection under any kind of nation Investors insurance policy item goes through the terms, conditions and exclusions in the actual policies as issued. Products and services described in this web site vary from one state to another and not all items, coverages or services are readily available in all states.

Your present browser might limit that experience. You may be utilizing an old internet browser that's in need of support, or settings within your browser that are not compatible with our site.

Index Whole Life Insurance

Currently utilizing an updated web browser and still having problem? Please offer us a call at for more aid. Your present web browser: Spotting ...

Latest Posts

Signature Indexed Universal Life

Universal Life University

Universal Retirement Protection